I was working with a new client on their life insurance needs this week. They just bought a farm with a 30 year mortgage and pregnant with their first child. They recognized the need for a life insurance review. They purchased a couple of annual renewable term life insurance policies 3 years ago from a friend that just got into the business. I asked why did they purchase annual renewable term life insurance? The answer was standard, because that is what the agent sold me. Let’s look at annual renewable term life insurance.

There is a need for annual renewable term life insurance in the market place. It is a policy designed to cover a short term need such as a loan to be repaid in a few years or an immediate debt like college education for a teenager. It was not designed to cover a long term need like income replacement, a 30 year mortgage or a newborn’s college education. I see this quite often from new life insurance agents under pressure to make a sale instead of helping the client’s needs. This can be devastating to an unsuspecting client.

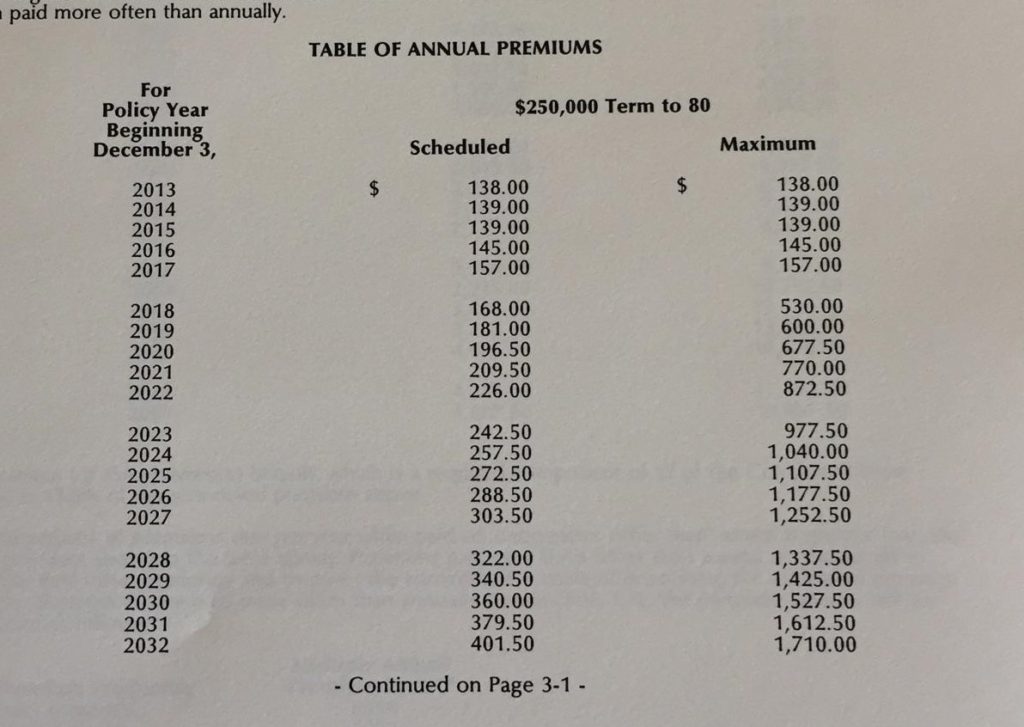

For example, the female age 32 with a preferred non tobacco rating purchased $250,000 in annual renewable term or ART for short for $138.00 annually. This is a good rate. However, ART life insurance increases premiums every year. Statistically, as you can see in the image, it will double every 10 years, so by year 30, her premiums will be at least$1,104 annually. The scary part happens when someone loses their insurability due to disease or an accident and they cannot replace this coverage.

With this client’s needs being long term not short term and with a modest budget, a 30 year term makes the most sense. At age 32 she could have purchased the same $250,000 for 10 years for $121.50 which is cheaper and guaranteed for 10 years. But the agent knew the commission is lower than the AR Term life insurance. She could have purchased a 20 year term for $169.00 which by year 5, according to the schedule, she will be paying and rates will continue increasing. The appropriate purchase should have been a 30 year term for $251.49 to meet the growing family needs at a more affordable rate than a whole life insurance or universal life insurance plan. Which by the way, on her current plan will increase to those rates by year 10.

Life insurance is too important to purchase online by yourself or from the “family friend” who just got into the business. Use an experienced reputable life insurance broker to review and purchase the right coverage for your unique situation and avoid a nightmare for your loved ones. At least learn the basics at Life Insurance 101.

Caveat Emptor—let the buyer beware.

Original image by Tim Wilhoit

yourfriend4life.com

Tim Wilhoit is owner/principal of Your Friend 4 Life Insurance Agency in Nashville, TN. He is a family man, father of 3, grandfather of 1, entrepreneur, insurance agent, life insurance broker, employee benefit specialist, salesman, sales trainer, recruiter, public speaker, blogger, author and team leader with over 29 years of experience in sales and marketing in the insurance and beverage industries.

Great, short, content rich article, Tim. Too many people are afraid of having a “snake oil salesman” insurance agent come to their house to help them. Instead they choose to buy online or from TV and make an uninformed, often incorrect decision. There is a reason Insurance Agents are licensed.

Gus, I really appreciate your feedback. I could not agree more. Life insurance is too important to purchase lightly and leave loved ones in a bad place when the unthinkable happens. Thanks for sharing Gus!

As an insurance agent myself I wholeheartedly agree with what you are trying to convey in your article. I noticed too many times where clients purchased something that is not suitable to their needs because nobody fully educated them on what it is that they are buying.

AL Williams made a ton of money selling ART, terrible product but that didn’t seem to slow them down.

Thinking about life insurance requires someone to think outside the pop cultural stream and social influences. You provide a clear example here for seeking a conscientious, competent and thorough professional. We also need a better effort for people to understand the need for permanent disability insurance.

Fred, thank you for sharing that, I could not agree more.

Hi Tim, I couldn’t agree more with you. Where I work there is no such thing as a renewable term life thank God. The purpose of the life cover product is to keep the people covered at a fixed cost unless they want to protect the buying power of their coverage. Thanks for your article!

Kieran, I really appreciate your kind words. Thank you for sharing.

Another problem is selling graded benefit whole life insurance to someone who could get immediate coverage.

Fred, I agree, the key word in your comment is “selling” instead of “helping’, “guiding” or “advising”. Selling doesn’t always help the client. Thanks for sharing that point.